Assess then Choose Medicare Advantage Plans: Save Hundreds on Insurance so you can Begin Here

Exploring Medicare Advantage Plans

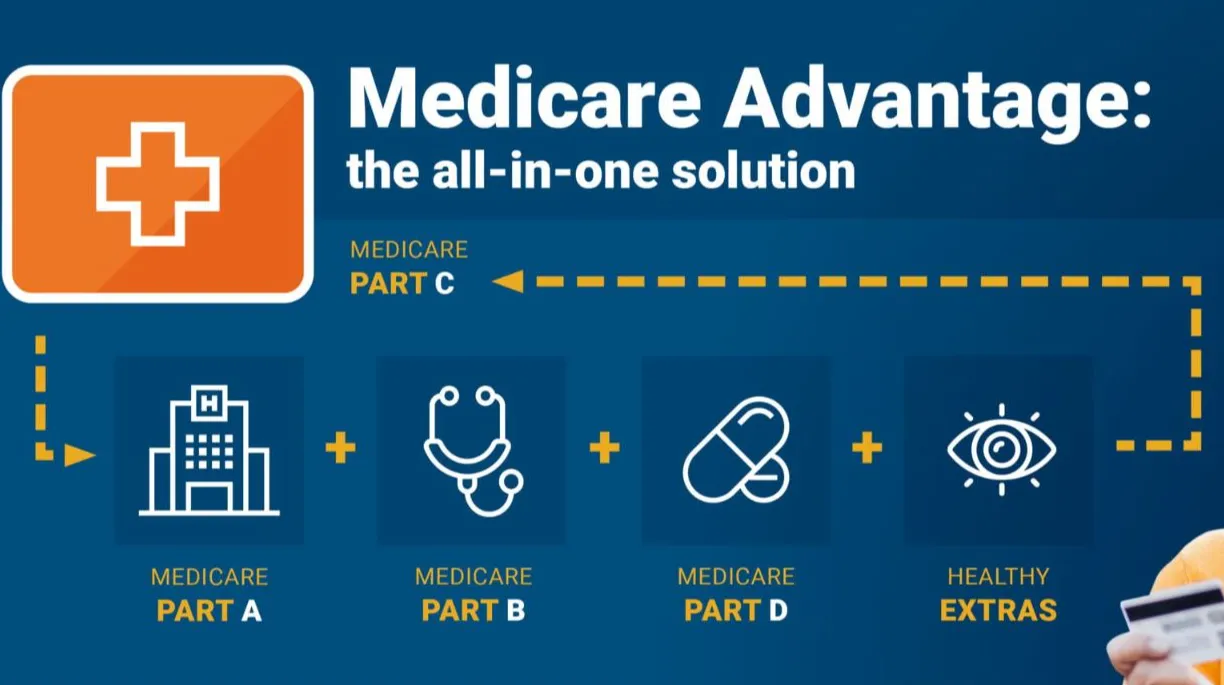

Medicare Advantage Plans exist as offered by private Insurance companies that contract with Medicare to offer Part A in addition to Part B coverage in a single combined structure. Unlike Original Medicare, Medicare Advantage Plans frequently include supplemental benefits such as prescription coverage, oral health care, eye care services, and also health support programs. These Medicare Advantage Plans operate within established coverage regions, which makes geography a important consideration during review.

How Medicare Advantage Plans Differ From Original Medicare

Traditional Medicare allows wide medical professional choice, while Medicare Advantage Plans often rely on managed provider networks like HMOs along with PPOs. Medicare Advantage Plans often include referrals as well as network-based providers, but they frequently offset those limitations with consistent costs. For countless enrollees, Medicare Advantage Plans provide a blend between cost control along with expanded services that Traditional Medicare by itself does not usually include.

Who Should Consider Medicare Advantage Plans

Medicare Advantage Plans appeal to people seeking coordinated care also expected financial savings under one plan structure. Older adults handling long-term conditions commonly choose Medicare Advantage Plans because connected treatment structures reduce complexity in treatment. Medicare Advantage Plans can also interest people who want combined benefits without maintaining several supplemental plans.

Qualification Guidelines for Medicare Advantage Plans

To be eligible for Medicare Advantage Plans, participation in Medicare Part A also Part B must be completed. Medicare Advantage Plans are open to most beneficiaries aged 65 in addition to older, as well as under-sixty-five people with eligible medical conditions. Enrollment in Medicare Advantage Plans is based on living status within a plan’s coverage region in addition to enrollment timing meeting approved sign-up windows.

When to Sign up for Medicare Advantage Plans

Scheduling holds a critical function when selecting Medicare Advantage Plans. The Initial sign-up window is tied to your Medicare qualification milestone plus permits first-time selection of Medicare Advantage Plans. Missing this timeframe does not necessarily eliminate access, but it does limit available opportunities for Medicare Advantage Plans later in the calendar cycle.

Annual with Qualifying Enrollment Periods

Each fall, the Annual Enrollment Period allows enrollees to change, remove, and also add Medicare Advantage Plans. Qualifying Enrollment Periods become available when qualifying events happen, such as relocation plus coverage termination, enabling changes to Medicare Advantage Plans outside the typical schedule. Understanding these periods helps ensure Medicare Advantage Plans remain available when circumstances shift.

Ways to Compare Medicare Advantage Plans Effectively

Comparing Medicare Advantage Plans requires care to beyond monthly PolicyNational.com Medicare Advantage premiums alone. Medicare Advantage Plans vary by network structures, out-of-pocket maximums, prescription lists, along with coverage guidelines. A thorough analysis of Medicare Advantage Plans supports matching medical priorities with plan structures.

Expenses, Coverage, and Network Networks

Recurring costs, copayments, also annual limits all influence the overall value of Medicare Advantage Plans. Some Medicare Advantage Plans include reduced premiums but higher cost-sharing, while others focus on consistent expenses. Provider access also changes, which makes it essential to check that chosen doctors participate in the Medicare Advantage Plans under evaluation.

Prescription Benefits and also Extra Services

A large number of Medicare Advantage Plans include Part D prescription coverage, easing medication management. In addition to medications, Medicare Advantage Plans may cover wellness programs, ride services, alternatively OTC allowances. Reviewing these extras helps ensure Medicare Advantage Plans align with ongoing medical priorities.

Enrolling in Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can happen digitally, by phone, even through licensed Insurance Agents. Medicare Advantage Plans require correct individual details as well as confirmation of qualification before activation. Submitting enrollment carefully prevents delays and also unplanned benefit interruptions within Medicare Advantage Plans.

Understanding the Value of Licensed Insurance Agents

Licensed Insurance professionals support clarify plan specifics in addition to outline distinctions among Medicare Advantage Plans. Consulting an expert can address network restrictions, benefit boundaries, together with expenses associated with Medicare Advantage Plans. Professional support commonly streamlines decision-making during sign-up.

Typical Missteps to Watch for With Medicare Advantage Plans

Ignoring provider networks details stands among the most mistakes when choosing Medicare Advantage Plans. Another challenge involves focusing only on monthly costs without considering total expenses across Medicare Advantage Plans. Examining plan materials closely prevents confusion after sign-up.

Reevaluating Medicare Advantage Plans Each Year

Medical requirements shift, along with Medicare Advantage Plans update each year as well. Evaluating Medicare Advantage Plans during open enrollment enables updates when coverage, costs, plus providers vary. Consistent review keeps Medicare Advantage Plans matched with current healthcare priorities.

Reasons Medicare Advantage Plans Keep to Increase

Enrollment data show rising interest in Medicare Advantage Plans across the country. Additional benefits, defined spending caps, with integrated healthcare delivery contribute to the growth of Medicare Advantage Plans. As choices increase, informed comparison becomes even more important.

Long-Term Benefits of Medicare Advantage Plans

For numerous enrollees, Medicare Advantage Plans deliver stability through connected coverage & managed care. Medicare Advantage Plans can minimize management complexity while promoting preventative care. Choosing appropriate Medicare Advantage Plans creates peace of mind throughout retirement stages.

Review & Enroll in Medicare Advantage Plans Now

Taking the next move with Medicare Advantage Plans starts by reviewing current choices as well as checking qualification. If you are currently entering Medicare alternatively reassessing current coverage, Medicare Advantage Plans offer adaptable coverage options built for different medical needs. Compare Medicare Advantage Plans now to find coverage that supports both your health as well as your budget.